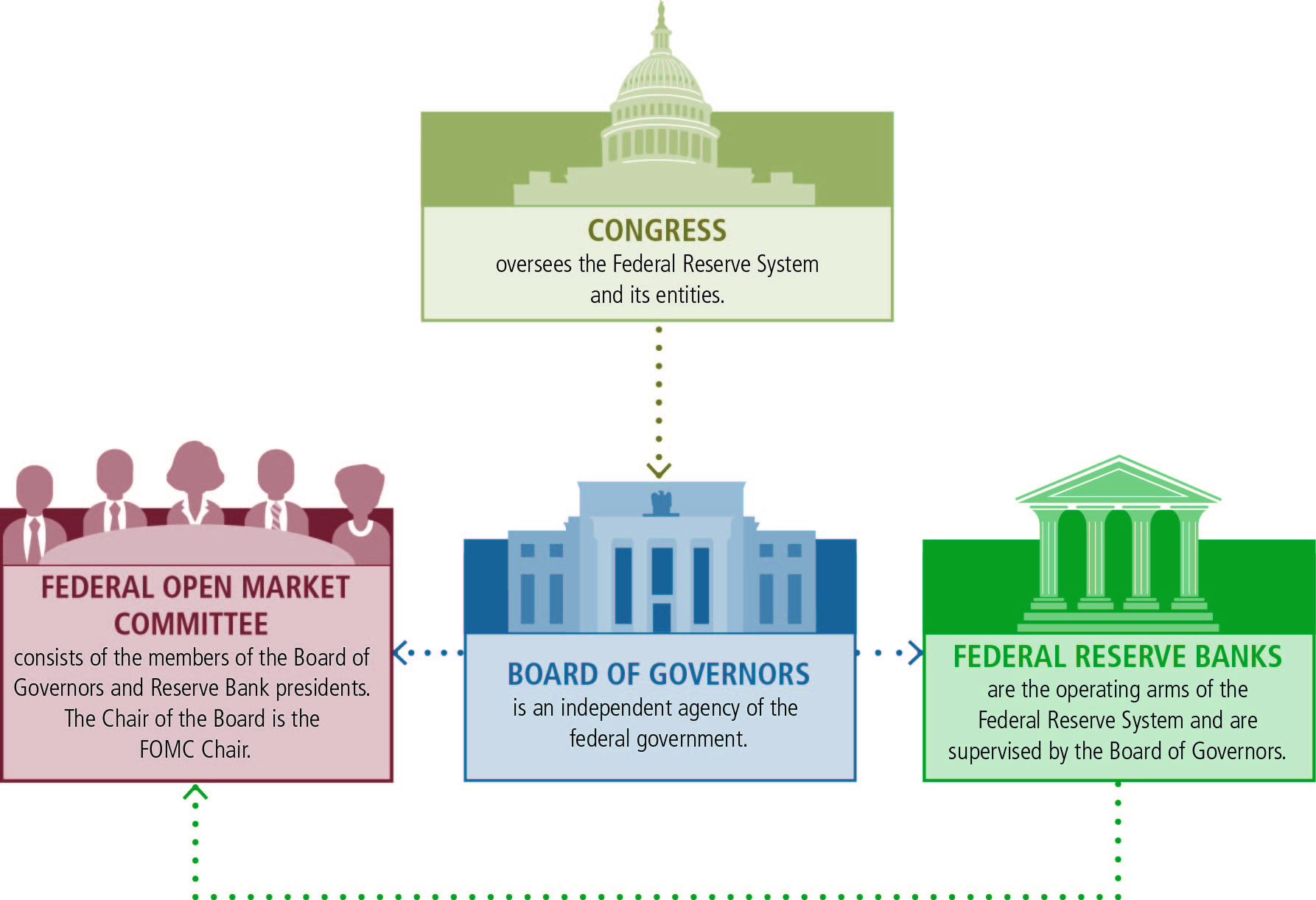

The board of governors, the federal reserve banks (reserve banks), and the federal open market committee (fomc). How the fed helps the economy.

Often called the fed, is the central banking system of the united states.

Explain the roles and responsibilities of the federal reserve system. The federal reserve acts as the u.s. The fed, as it is commonly known, regulates the u.s. The federal reserve is the united states central bank and was created by congress to provide a more flexible, stable, monetary and financial system.

Explain the roles and responsibilities of the federal reserve system. The federal reserve system (frs) is the central bank of the united states. The board also supervises and regulates the federal reserve banks, exercises responsibility in the nation’s payments system, and administers consumer credit protection laws (including the truth in.

These responsibilities fall into four broad categories. The federal reserve system works to promote the effective operation of the u.s. The fed is in charge of regulating money supply within the economy of nations.

That regional information is represented in national policy decisions and that the fed remains. The federal reserve system, often referred to as the federal reserve or simply the fed, is the central bank of the united states. The federal reserve is the central bank of the united states.

Through monetary policy, which influences the availability of money and credit, the fed plays a major role in keeping inflation in check while. “the most important tool the fed has to conduct monetary policy is the buying. It is a financial system that oversees the monetary system in the united states and provides the country with a.

The fed monitors economic conditions and enacts policy measures, such as raising or. (money demand) suppose that you never carry cash. They have to supervise and regulate the banking institutions and systems to make sure the bank maintains the required reserve ration and liquidity level.

If it decided to change the money supply by changing the required reserve ratio, what change should it make? (monetary tools) what tools does the fed have to pursue monetary policy? Despite being an executive agency, the financial body is largely independent of the control of the president or congress and is described as being “independent within the government.”.

The specific duties of the fed have changed over time as banking and economics have evolved. (monetary control) suppose the money supply is currently $500 billion and the fed wishes to increase it by $100 billion. 4 explain the roles and responsibilities of the federal reserve system one roll.

Economy and, more generally, to serve the public interest. The federal reserve bank is the central bank of the united states and arguably the most powerful financial institution in the world. The fed manages inflation, regulates the national banking system, stabilizes financial markets, protects consumers, and more.

Structure of the federal reserve system helps to ensure. Often referred to as the fed, the federal reserve system (frs) is the central bank of the united states and perhaps the most powerful financial organization globally. The federal reserve system (also known as the federal reserve or simply the fed) is the central banking system of the united states of america.it was created on december 23, 1913, with the enactment of the federal reserve act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial.

4 explain the roles and responsibilities of the federal reserve system one roll from economics 413 at michigan virtual school. Central bank, and in that role performs three primary functions: The federal reserve bank was founded by.

The fed performs several key functions. The federal reserve advances supervision, community reinvestment, and research to. First let me talk about the federal reserve system (federal reserve, fed) and explain why it was created and its responsibilities.

Although the fed board members are appointed by the president, it is designed to function independently of political influence. Under the chair’s leadership, the board’s responsibilities include analysis of domestic and international financial and economic developments. The federal reserve was created on december 23, 1913, when president woodrow wilson.

The board of governors, the federal reserve banks (reserve banks), and the federal open market committee (fomc). Which tool does it use the most? Goal of the federal reserve system.

There are three key entities in the federal reserve system: Why may the fed be reluctant to change the reserve requirement? The federal reserve is primarily the central bank of america.

It was created by the congress to provide the nation with a safer, more flexible, and more stable monetary and financial system. The fed banks clear and process one third of all checks in the. O help the economy achieve stable prices, full employment, and economic growth.

Often called the fed, is the central banking system of the united states. Supervising and regulating bank operations; Maintaining an effective, reliable payment system;

Given a required reserve ratio of 0.25, what should it do? Given a required reserve ratio of 0.25, what should it do? Fostering payment and settlement system safety and efficiency:

It oversees the financial services industry and works to keep prices stable by initiating monetary policies based on forecasts of the economic future. How the fed helps the economy. The federal reserve system is responsible for maintaining the health of the banking and financial systems.

It was established to give the nation a monetary and financial system that was secure, adaptable, and stable.