Financial planner duties and responsibilities. Financial planner duties and responsibilities.

Financial advisors advise clients on investments, taxes, estate planning, college savings accounts, insurance, mortgages, and retirement.

Roles and responsibilities of financial planner. Monitor kpis and identify the cause of any unexpected variances. Everyone has different financial resources, lifestyle needs and personal aspirations, so the right kind of. Financial advisors advise clients on investments, taxes, estate planning, college savings accounts, insurance, mortgages, and retirement.

Financial planner job description should contain a variety of functions and roles including: Financial planners need an assortment of qualities to perform their job optimally: Learn about the key requirements, duties, responsibilities, and skills that should be in a financial planner job description.

If the financial plan is a map, then the role of the financial planner is to be the guide in the changing landscape of a client’s life. Ability to analyze the market�s financial data and provide proper financial. They are also known as personal financial advisors, financial planners, financial.

While a financial planner’s primary duty is to strategize ways to achieve the financial goals of their employer, several unique duties and responsibilities work together to accomplish that end. Identify and cultivate new clients. Learn about the key requirements, duties, responsibilities, and skills that should be in a financial advisor job description.

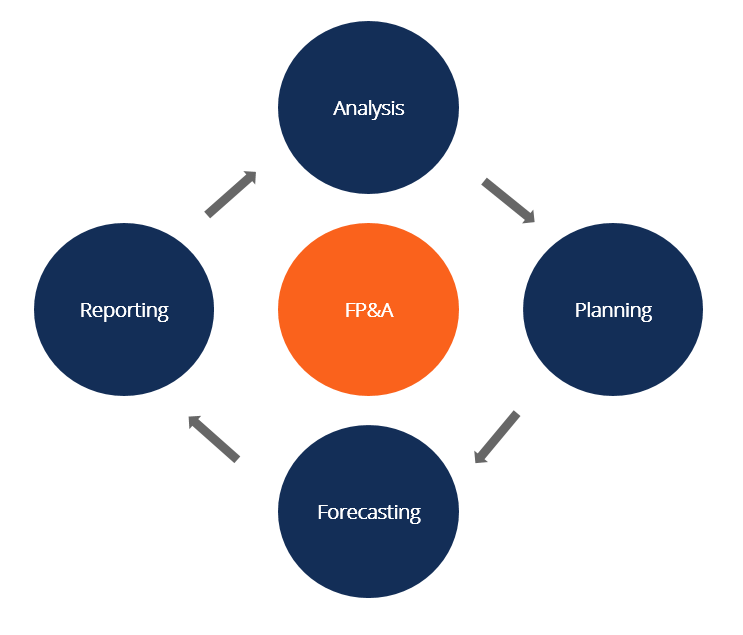

Responsible for global financial planning, analysis, management and reporting. Ensure the company’s profitability, liquidity, and solvency; Develop and continually improve budgeting, financial projections, and operating forecast.

Once a financial plan is created, the only thing we know for certain is that the plan will change. Develop and execute retirement planning. The most important duties and responsibilities necessary to excel at the position include:

Financial planner duties and responsibilities. To offer professional financial advice for customers, helping them to identify problems, solve crises and avoid investment mistakes. Here we discuss the list of top 12 responsibilities, i.e., due diligence, treasury, financial reporting, investment banking, commercial banking, etc.

Use the following job description template when hiring for a financial planning and analysis manager and customize it further based on your specific requirements. Forecast financial future and anticipate monetary needs of. Financial planners can help clients avoid financial pitfalls associated with tax responsibilities by planning ahead and avoiding surprises.

This has been a guide to the role of a financial analyst. So, the companies can reach their financial goals sooner with accuracy. Many clients rely on financial planners to help them streamline the transition of their estate to family members, charities, or other entities in cases of being incapacitated or when.

It encompasses where you are today, your goals, resources, and your desired future state. A financial advisor is a financial planning partner. Provide financial planning and investment advisory services.

Financial planner helps individuals or. According to the bureau of labor statistics, as of may 2020 (the most recent data available), the total compensation for a financial planner ranged from roughly $44,100 to more than $208,000. Support, analyze, and assist in the preparation and review of the company�s operating and capital budget and forecast.

To educate customers of the importance of wealth management, and to assist them to know more about various financial tools in order to achieve their goals right away. Learn more about the responsibilities. Monitor clients’ accounts and determine if changes are needed to improve account performance or to accommodate life changes, such as getting married or having children

A financial planner can help you plan to achieve lifestyle and financial goals. Financial planner duties and responsibilities. Target and assign all significant responsibilities.

Making sure it earns the maximum return on liquid assets and incurs minimum expenses on borrowed capital. Financial planners are responsible for the analysis of financial status, the development of budgets, and the preparation of analyst reports that pertain to their clients and duties. Exceptional communication, presentation, and negotiation skills communications and interpersonal.

He/she provides financial advice to companies regarding all kinds of money matters such as investment management, tax planning, saving suggestions, and several other matters involving the flow of money. Research and present investment strategies. Consolidate and analyze financial data (budgets, income statement, forecasts, etc.).

Ensure that margins on jobs are maximized through cost recovery. A financial plan is a map of where you are trying to go. Financial planners and other personal financial advisers play a substantial role in helping people plan for, and reach, their financial goals.

Financial planners analyze the financial statements of a company or individual to identify risks, rewards, and opportunities. Implement risk management and tax planning strategies. Financial planner works with other professionals, like attorneys, accountants, and investment bankers, to help an individual or family meet their financial objectives.

Analyze the trends of key performance indicators (kpis), especially relating to financial metrics such as sales, expenditures, and profit margin. Visit edelweiss mf to read more. The role of a financial/investment planner include things like keeping finances in order, planning for future generations, etc.

They perform evaluations of their clients’ financial documents, including their income, expenses, and their liabilities, and provide support and financial guidance.