Sometimes clients can get enraged and demand something that isn’t possible. The role of a relationship manager isn’t easy.

Maintain primary ownership of a portfolio of islamic growth account clients, differentiated by the level of complexity of the client base.

Roles and responsibilities of relationship manager in bank. You’ll have a quota and regular goals to meet. They are in charge of developing and maintaining customer relationships, managing customer expectations, and resolving any issues that arise. Resolving customer complaints quickly and efficiently.

Maintain primary ownership of a portfolio of islamic growth account clients, differentiated by the level of complexity of the client base. Welcome to the world of the relationship manager. You‘ll research new business prospects and pitch the companies with your own bank’s products.

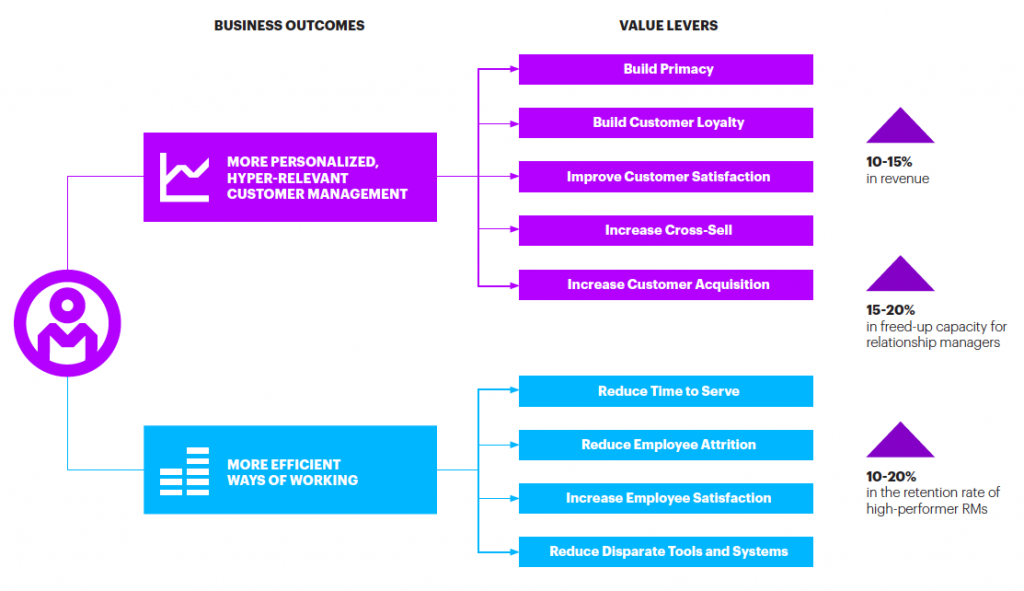

Partners with other business lines as appropriate. Rms can work for the bank either internally or externally, depending on their level of responsibility. A relationship manager is a professional who aids in developing and maintaining strong customer relationships, both within a company as well as with outside clients.

Business banking is looking for an experienced deepening banker to retain and deepen existing relationships and leverage referrals to acquire new relationships in order to position chase as the primary bank for our clients. Based within the banking or financial sector, a relationship manager’s role involves working with clients to help them make the right decisions with their accounts and explain the financial services on offer to them. The centre most of their time developing connections by associating clients to deals subject matter experts and offering fitting monetary arrangements and administrations to both.

He is also expected to source new business. A relationship banker is responsible for providing financial advice by applying financial disciplines in the banking industry. They give clients personalized advice, build rapport and provide quick responses to their inquiries.

Sometimes clients can get enraged and demand something that isn’t possible. In the banking industry, relationship managers (rms) play a critical role. Identifying clients� needs and requirements and proposing suitable solutions.

The relationship manager i (business banking) works on projects/matters of limited complexity in a support role. The role of a relationship manager isn’t easy. Seattle bank explains that one of the primary roles of the commercial banking relationship manager is sales.

Retail and banking are the two sectors that mainly hire professionals for these roles. 21 to 30 yrs old. Acts as liaison between business credit.

Building and maintaining strong relationships with prospective and existing clients. Find surveys for this job. Proactively follows up on credit requirements.

Researching and pursuing new business opportunities. By mary ellen biery, research specialist,. Strong understanding of bank operations in addition to lending.

If you are a student from the tertiary institutions, please click here. The scope of work is vast, and it includes helping clients make informed decisions. A relationship manager in a bank, for instance, needs to be completely aware of the loans the bank offers, so he/she can explain the same to a curious customer.

Building and maintaining profitable relationships with key customers. Managing clients� investment portfolios to ensure financial success. Post this job for free.

Work quickly to address and resolve customer issues. Become familiar with the competition to stay ahead of them. Minimum 3 months experienced in any industry / fresher.

Consulting and advising customers on appropriate investment options. Overseeing the relationship with customers handled by your team. This portal is for students and teachers in primary schools, secondary schools and junior colleges/centralised institutes.

He is expected to achieve the business targets allocated. 11500 to 15000 per month. Ability to deal with stress and follow procedures.

Relationship managers are the substance of bank of america in their monetary focuses, rejuvenating their items and administrations for their customers in general. Responsibilities for banking relationship manager. They seek out new business opportunities for their clients while advising them on products or services that best fit their needs.

Responsibilities for business banking relationship manager. Relationship manager duties and responsibilities. To understand what does a bank relationship manager do, here are some of their responsibilities:

Relationship bankers process financial transactions on their clients� bank accounts, generate account statements, and reiterate bank policies to support clients� financial goals and objectives. Source prospects and develop new customer relationships in technology lending. Updating clients and customers on their portfolio activity and success.

Clearly communicates the application and credit decision process. You’ll call on and make appointments with new businesses and existing companies banking. Discussing major financial goals of clients to better understand their objectives.

Duties and responsibilities of a relationship manager. Maintaining a deep knowledge of company products and services. Relationship manager functions are given below:

Relationship managers help businesses to maintain positive relationships with their clients/customers. Preparing and implementing action plans and programs for mobilizing deposits, the opening of accounts, and obtaining new profitable corporate business. Keeping customers updated on the latest products in order to increase sales.

A relationship manager is allocated a set of clients to manage. Create and enforce plans that will help meet the needs of customers. Relationship managers build and maintain relationships with clients and partners.

There are client relationship managers and business relationship managers.