Government, supervise and regulate certain types of financial. The specific duties of the fed have changed over time as banking and economics have evolved.

The federal reserve acts as the u.s.

Roles and responsibilities of the federal reserve system. (federal… continue reading responsibilities of the. The federal reserve advances supervision, community reinvestment, and research to. The federal reserve was established by the federal reserve act in 1914.

Get your custom essay on responsibilities of the federal reserve system just from $9/page order essay macroeconomics 7. Macroeconomics7 don�t use plagiarized sources. The specific duties of the fed have changed over time as banking and economics have evolved.

How the fed helps the economy. The fed’s duties today are to provide financial services to depository institutions and the u.s. Under the chair’s leadership, the board’s responsibilities include analysis of domestic and international financial and economic developments.

View roles and responsibles of federal reserve directors.pdf from badm 2150 at cuyahoga community college. The federal reserve system, also known as the fed, is the central banking system of the united states. Roles and responsibilities branch office directors.

It was created in 1913, when congress enacted the federal reserve act. The federal reserve acts as the u.s. The federal reserve system works to promote the effective operation of the u.s.

The fed monitors economic conditions and enacts policy measures, such as raising or. Supervising and regulating bank operations; Economy and, more generally, to serve the public interest.

It oversees the financial services industry and works to keep prices stable by initiating monetary policies based on forecasts of the economic future. “the most important tool the fed has to conduct monetary policy is the buying. The federal reserve system is responsible for maintaining the health of the banking and financial systems.

(federal reserve or system) conducts the nation’s monetary policy and helps to maintain a stable financial system. The board also supervises and regulates the federal reserve banks, exercises responsibility in the nation’s payments system, and administers consumer credit protection laws (including the truth in. Despite being an executive agency, the financial body is largely independent of the control of the president or congress and is described as being “independent within the government.”.

The federal reserve system (also known as the federal reserve or simply the fed) is the central banking system of the united states of america.it was created on december 23, 1913, with the enactment of the federal reserve act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial. Branch directors serve in an advisory capacity, and their input into economic discussions and the connections they make to the broader community are important and valuable contributions to the federal reserve system. Definition of the federal reserve system.

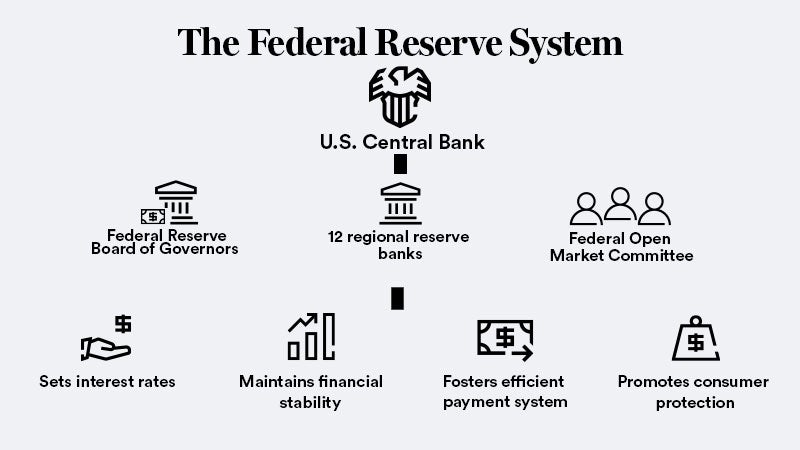

4 roles and responsibilities of federal reserve directors structure structure of the federal reserve system. The duties and responsibilities listed in this job description generally cover the nature and level of work being performed by individuals assigned to this positionthis is not intended to be a complete list of all duties, responsibilities, and skills requiredsubject to the terms of an applicable collective bargaining agreement, the company. Maintaining an effective, reliable payment system;

Central bank, and in that role performs three primary functions: It is commonly referred to simply as the fed.the fed serves as the central bank of. Roles and responsibilities of federal reserve directors federal reserve system [official

Government, supervise and regulate certain types of financial. As community ambassadors of the federal reserve, they strengthen.