Develop and execute retirement planning. Provide financial planning and investment advisory services.

/financial-advisor-consulting-with-young-couple-in-living-room-1014364972-ed8a401c658d4c78abd30d643a9b082f.jpg)

Support, analyze, and assist in the preparation and review of the company�s operating and capital budget and forecast.

Roles and responsibilities of wealth planner. Customize financial plans according to clients’ changing needs. Financial planners must have sufficient education, training, and experience for. Get the right wealth planner job with company ratings & salaries.

Their key duties and responsibilities include: Scheduling events, programs, and activities, as well as the work of others. / clarify the respective roles and responsibilities of financial planning.

Help clients implement their plans and carry out transactions. Their work commonly involves the use of wealth management. Their main duties include developing strategies to help clients maintain their financial goals, analyzing.

Implementing the wealth management process. Usually, a company creates a financial plan immediately after the vision and objectives have been set. Financial planning ability is a core competence of a modern accountant.

Apply to wealth planner jobs now hiring on indeed.co.uk, the world�s largest job site. Develop and execute retirement planning. The 8 roles of a financial advisor.

Financial planner works with other professionals, like attorneys, accountants, and investment bankers, to help an individual or family meet their financial objectives. Consolidate and analyze financial data (budgets, income statement, forecasts, etc.). Financial advisors are guardians of financial wellness and have a vested interest in seeing your retirement savings grow.

Encouraging and building mutual trust, respect, and cooperation among team members. Looking for wealth planner job vacancies as of may 2021 in sri lanka? Financial planner duties and responsibilities.

Implement risk management and tax planning strategies. Income, expenses and liabilities) examine and suggest financial opportunities (e.g. Cash flow, investment, tax, insurance, options, retirement, estate.

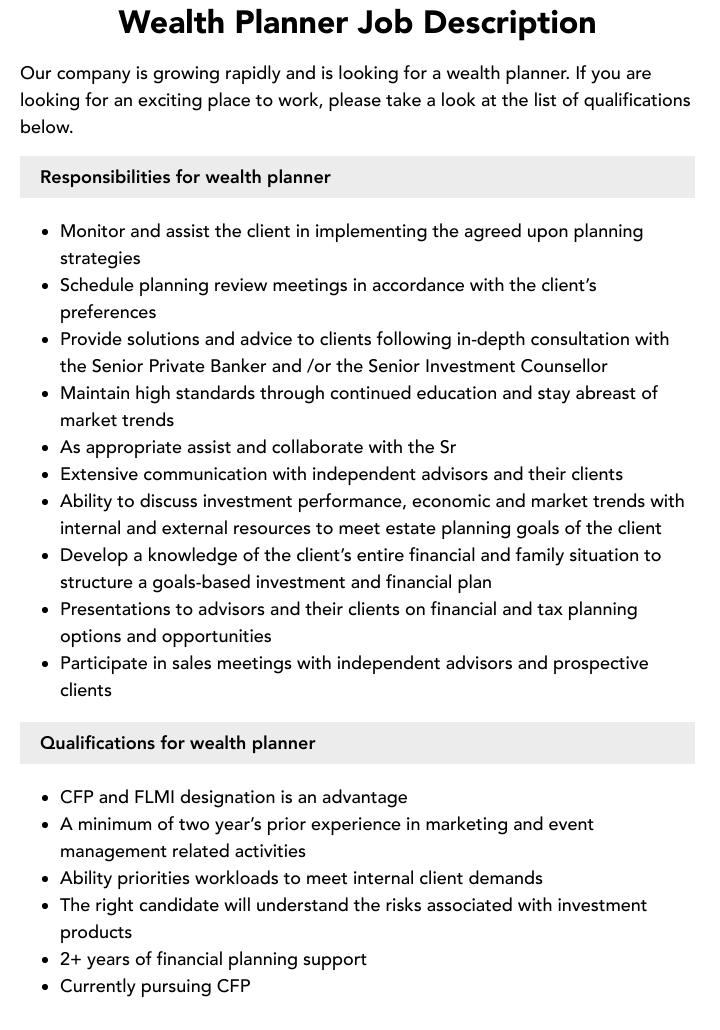

Wealth planning duties & responsibilities to write an effective wealth planning job description, begin. Roles and responsibilities of a planner b. Analyze clients’ financial statuses (e.g.

Financial planners analyze the financial statements of a company or individual to identify risks, rewards, and opportunities. This, in turn, prepares them for a wealth management career. Provide financial planning and investment advisory services.

Buying and selling stock on behalf of the client. According to the bureau of labor statistics, as of may 2020 (the most recent data available), the total compensation for a financial planner ranged from roughly $44,100 to more than $208,000. Support, analyze, and assist in the preparation and review of the company�s operating and capital budget and forecast.

The candidate who becomes a certified financial planner professional is required to hone proper expertise and experience in the field of financial planning. Visit edelweiss mf to read more. Identify and cultivate new clients.

Search and apply for the latest wealth planner jobs. They often recommend or promote specific products and services offered by their firm or financial institution. Also referred to as wealth management advisors, these qualified experts are responsible for analyzing financial statuses, developing budgets, and preparing analysis reports.

Wealth management is a professional advisory assistance that provides clients with comprehensive solutions for finance, investment, planning, insurance, plantation and legal planning, mutual and equity funds, and banking products. A financial planner, or wealth management advisor, reviews a company’s or individual’s financial statements and finds any potential risks or opportunities for growth. Find wealth planner job vacancies with estimated salary.

Responsible for global financial planning, analysis, management and reporting. They may have working relationships with financial advisers, investment managers, or mutual fund companies, utilizing these specialists for the actual investment of their clients� funds. Roles and responsibilities (working for client) project planning and monitoring 1.

The role of a financial/investment planner include things like keeping finances in order, planning for future generations, etc. Financial planner helps individuals or. Wealth planning provides professional consulting / advisory services and solutions to clients through the development, delivery and implementation of financial planning:

Research and present investment strategies. A financial planner helps clients create personal budgets, control expenditures, set goals for saving, and implement strategies for accumulating wealth. Planning • understanding the scope of work, contractual start and finish dates of the different packages / contractors.

Financial planners are also called wealth management advisors and are responsible for the analysis of a company or an individual to identify their financial risk, reward, or opportunities. The roles and responsibilities of a certified financial planner professional can be divided into the following elements. Advising clients on financial products and services.

They are experts in regulation and best practices and in the various financial products that are available to investors on the market. • understanding the deliverables of various packages / contractors. Financial planners are primarily responsible for providing their clients with the best financial advice possible.

When consulting with various investment companies, you should ask your wealth manager about their financial products. Insurance plans, investments) develop sound plans and budgets for clients. Read the director, wealth planning job description to discover the typical qualifications and responsibilities for this role.

What does a director, wealth planning do? The wealth management specialist identifies the client’s major priorities or objectives and develops an investment plan or asset management strategy that supports those goals. Advisors specialize in different areas of finance, but for retirement planners, we offer our clients the following services.