Interpersonal skills also include empathy, communication and active listening. Keeping track of all payments and expenses including vendor invoices, payroll expenses, purchase orders, and operating expenses of a business.

Keeping track of all payments and expenses including vendor invoices, payroll expenses, purchase orders, and operating expenses of a business.

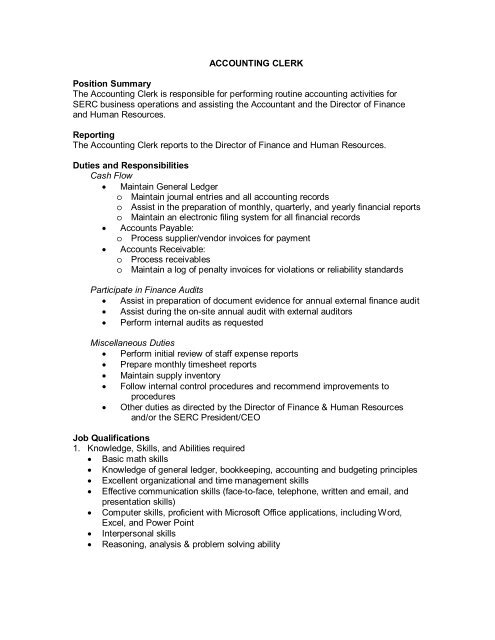

What are the roles and responsibilities of a accounting clerk. Accounting clerk duties and responsibilities. Assist supervisors and department heads in the accounting department. Using bookkeeping databases, spreadsheets, and software such as microsoft excel.

Processes and obtains approval for disbursements. Acquiring a bachelor�s degree as an accounting clerk will make you qualified to work as an accountant or accounting manager, thus earning more. Prepare and manage bank deposits.

Reconcile monthly bank statements and other kinds of. Other duties and responsibilities include: The specific duties that an accounting clerk is responsible for performing depend largely upon the specific role that the clerk is assigned within a business organization.

Maintaining the vendor accounts for timely payments and compliance with internal controls. Supports accounting operations by filing documents, reconciling statements, and running software programs. Add or revise duties and responsibilities that are specific to your organization and current projects.

Their duties involve clerical tasks such as data input, reporting along. They are responsible for tracking incoming and outgoing money from a company’s accounts. Similar job titles include assistant accountant, staff accountant, junior accountant.

Location ‐ san francisco (financial district) provides accounting and clerical assistance to accounting department. Maintains accounting databases by entering data into the. Accounting clerk duties and responsibilities.

Years of experience most commonly required: An accounting clerk is primarily responsible for ensuring the accurate and timely filing of records to keep the company books up to date. Enters information into quickbooks accounting system.

Prepare for the vouchers, billing, its invoices and checks. Secures financial information by completing. They may also be responsible for payroll or maintaining vendor accounts and processing procurement requests for goods and services.

Experience with or knowledge of accounting principles, including the recording and measurement of business or financial transactions in any field of practice. Maintains accounting records by making copies and filing documents. Enter key accounting and financial.

As of november 29, 2021, the average accounting clerk i salary in the united states is $41,450, while the range frequently ranges between $36,956 and $46,408. Typical duties of an accounting clerk include data entry, bookkeeping, and tracking invoices. Account clerks manage accounts and provide support for the accounting, finance and sales departments.

Accounting clerks’ responsibilities often vary based on their level of experience. Be a resource for accounts payable and receivable. Accounting clerk duties and responsibilities.

Assist with regular bank reconciliations. Apply accounting principles, regulations, and policies to all work duties. Interpersonal skills also include empathy, communication and active listening.

Prepare and manage various accounting documents and records. Maintaining a database, ensuring that records are complete and current. Execute accurate reporting, filing, and database management in multiple systems.

Some accounting clerks are expected to take on specific duties in payroll, auditing and accounts receivable/payable departments, while others are responsible for general. Accounting clerk duties and responsibilities. Perform general office support like filing and other administrative tasks.

Other roles and responsibilities of an accounting clerk include: Collect and sort invoices and checks Reconcile accounts in an accurately and timely manner.

Interpersonal skills include collaboration and allow account clerks to work well as part of a team. Reconcile bank statements, encode and enter accounts payable. They can also be responsible for monitoring accounts and loans.

The accounting clerk also provides the solution to auditors. Here are some commonly found skills and other specifications in job postings for accounting clerks. Account clerk duties and responsibilities.

Managing accounts payable and accounts receivable. This accounting clerk job description template is optimized for posting on online job boards or careers pages and is easy to customize for your company. The duties and responsibilities will vary from company to company but the primary job tasks and requirements for an accounting clerk position are clearly detailed in this job description.

Be clerical support to our company�s accounting department. Recording information, processing, and filing forms. Reconciles bank statements by comparing statements with the general ledger.

On a daily basis, enter data into accounting systems and update various excel spreadsheets. Maintains an organized and efficient filing of records. Compilation of documents and sort invoices, bills and checks.

Preparing checks, deposits, budgets, and financial reports. They can be empathetic to ensure the best experience for both parties. Salary ranges are influenced by education, certifications, supplemental skills, and the number of years you’ve worked in your area.

Generally, the roles and responsibilities of an accounts payable clerk will include the following tasks. Maintain, verify, and update numerous ledgers. Performing basic office tasks, including answering phones, responding to emails, processing mail, filing, etc.

The accounting clerk works in the accounting department of the company. They can also be responsible for monitoring accounts and loans. Among the many tasks that an accounting clerk may perform, some of the most common include:

Receiving and recording cash and cheques. Account clerks often speak with customers to collect bill payments. They take care of accounting tasks such as maintaining the office books, reporting the financials to the senior, keeping track of various costs and revenue tracks such as invoices, and assigning them per ledger.

Accounting clerks’ responsibilities often vary based on their level of experience. Keeping track of all payments and expenses including vendor invoices, payroll expenses, purchase orders, and operating expenses of a business. Maintains accounting department files and records.

You can adapt this practical accounts clerk job description for your own specific use and be sure that the job is clearly defined in terms of job tasks.