And potential threats to monetary transactions. The roles are based on various factors such as:

Assist the company in establishing specialist risk policies.

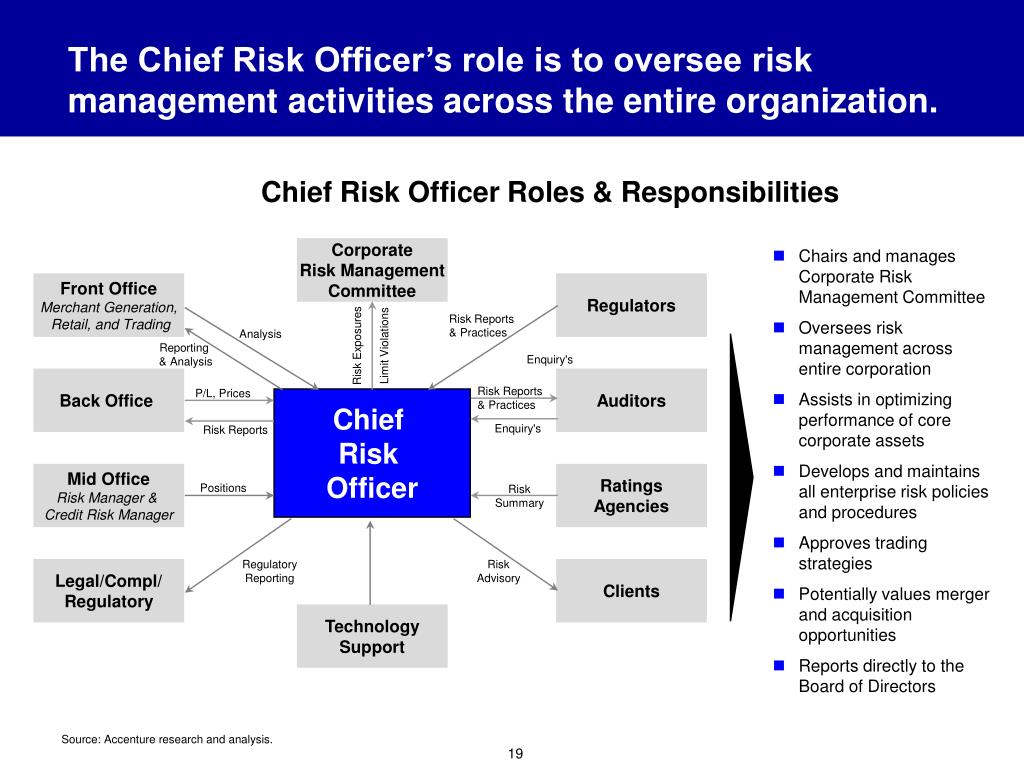

What are the roles and responsibilities of a chief risk officer. The cro of a bank, for example, should be familiar with financial compliance requirements, fraud prevention, and potential threats to monetary transactions. Enterprise risk management is becoming an important component of corporate governance as evidenced by the many firms that have either created the position of a chief risk officer (cro) or elevated the cro to the membership of the top management team. A chief risk officer is an executive responsible for identifying, analyzing and mitigating internal and external events that could threaten a company.

The major tasks, duties, and responsibility that commonly make up the risk officer job description are listed below: The position of chief risk officer is constantly evolving. The chief risk officer is a senior management position, typically found in regulated large financial institutions such as banks and insurance companies roles and responsibilities.

Support investigations of incidents and near misses. The results reveal that the key roles and responsibilities of the cros can be mapped into the three main mintzberg’s classical managerial roles of interpersonal (leader, liaison), informational. A chief risk officer is responsible for monitoring the organization�s overall operational procedures and regulatory processes to evaluate risk levels and minimize risk exposure.

The cro job is an executive role. Consult with relevant units to determine, quantify, and mitigate risks involved in establishing and maintaining various client and industry relationships. Learn about the chief risk officer role in data protection 101, our series on the fundamentals of information security.

The cro is responsible for all risk management strategies and operations, as well as. Defining the roles and responsibilities between line one and line two (risk management) (50. Risks are commonly categorized as strategic, reputational, operational,.

Organizations and companies typically assemble a risk management team to help decision makers go through the risk management process. The chief risk officer (cro) is rapidly becoming one of the most crucial members of the management team.a rising number of cros and numerous regulatory risks associated with global business reflect just how important the position has become for companies. The roles are based on various factors such as:

It is worth noting that there are no specific defined roles of a cro. The size of the organization: The chief risk officer (cro) or chief risk management officer (crmo) or chief risk and compliance officer (crco) of a firm or corporation is the executive accountable for enabling the efficient and effective governance of significant risks, and related opportunities, to a business and its various segments.

Risk managers are in charge of research activities such as risk assessment for current company affairs or risk. What does a chief risk officer do? However, few studies have explored the roles and responsibilities of the cros.

The chief risk officer a study of roles and responsibilities keywords: Having the board of directors meet with the chief risk officer, ideally sometimes without the ceo or other members of senior management present, can allow the board to receive an unvarnished assessment of the institution’s risk management program. A risk officer is a corporate executive who is responsible for identifying, analyzing and reducing internal and external risks.

Larger organizations have specific roles for this position separate from that of a chief security officer and chief information officer. Assist the company in establishing specialist risk policies. Develop specialist contingency and recovery plans.

While the team members do not have to be risk experts, they must gain an understanding of the environment in which the risks are to be managed, taking into account political and. Main risk management roles and responsibilities for specialist risk management functions. The chief risk officer a study of roles and responsibilities author:

The chief risk officer reviews factors that could hurt the company�s business units and ensure that the company complies with government regulations. Chief risk officer essentials are covered, from every angle: Chief risk officers maintain the safety and security of all the databases and ensure the confidentiality of information from unauthorized access and distribution.

As one would guess, the responsibilities of a chief risk officer largely depend on an organization’s size as well as its industry. And potential threats to monetary transactions. Responsible for assessing metrics and monitoring procedures the.

The chief risk officer ( cro) or chief risk management officer ( crmo) of a firm or corporation is the executive accountable for enabling the efficient and. The, chief, risk, officer, a, study, of, roles, and,. The role of the risk officer.

Typical duties and responsibilities of a chief risk officer. In this article, we discuss the role of a chief risk officer, including skills, salary and career path. The chief risk officer’s responsibilities and qualifications vary by sector and organisation size.

The cro has primary responsibility for overseeing the development and implementation of the firms risk management function.