The duties under a risk management job description include the following: 5 rows use this reference to describe roles and responsibilities when it comes to managing risk.

Managing risk management activities to isolate accountability;

What are the roles and responsibilities of a risk manager. These professionals perform audits at regular intervals and execute design control systems, advising the management on possible. Performing risk evaluations and assessments. Gather confidential financial information from client such as income, assets and debts.

In this section, you will state the duties and responsibilities you have successfully carried out or are presently performing in your role as an information technology risk manager. Read the finance and risk manager job description to discover the typical qualifications and responsibilities for this role. 5 rows use this reference to describe roles and responsibilities when it comes to managing risk.

Recruiters hunt for people who can effectively perform the obligations, objectives, and purpose of the it risk manager role in their organization; Market fluctuations pose a variety of uncertainties for the players. The duties of a risk manager can vary, based on where they work, though common responsibilities often include:

A risk manager is responsible for analyzing potential risks that may affect the organization�s operations, reputation, and market credibility. Here are 10 jobs to consider for a career in risk and compliance management: The role of the risk manager.

2+ years of experience in risk management or a related role. Making recommendations to subdue risk factors. Risk managers are always in demand—the economy grows—identity thefts and data breaches increase.

The risk manager�s responsibilities include conducting extensive research and assessments to evaluate risk levels and develop contingency plans and solutions that reduce and control risks and liabilities. Prepare risk management and insurance budgets and. Most risk managers hold bachelor�s degrees in business, management or another related field.

Perform risk evaluation, which assesses the. The focus will be on managing methodology, valuation as well as stress testing. As people who manage company risks, risk managers have the following duties and responsibilities:

Identify financial, safety or security risks that the client company or organization may face. Review and give an assessment of all suspicious account activity ; Conduct research into possible fraud and report on any findings;

Risk manager duties and responsibilities. Many risk managers begin their careers as risk assistants or risk analysts and move into manager roles once they have enough experience. Forecasting and analyzing market trends.

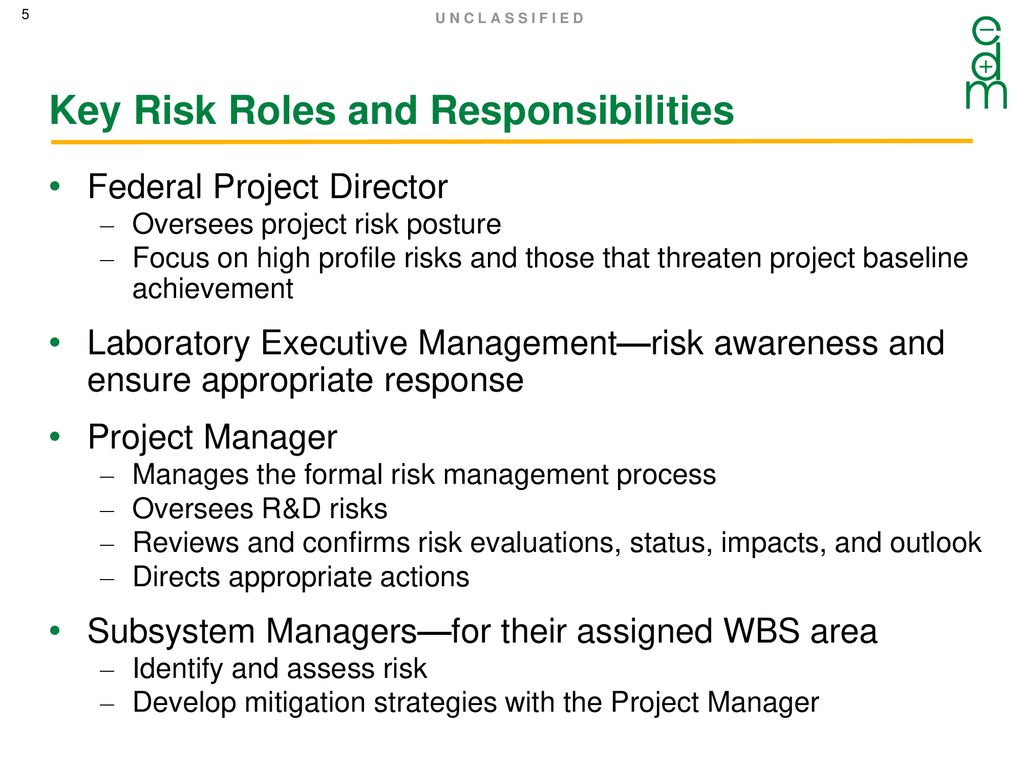

They also develop compliance training and programs for. In our previous article about the risk management process, we looked at how to identify, assess, and respond to project risks.in this article, we examine the roles and responsibilities of a risk management team. The duties under a risk management job description include the following:

Creating and implementing risk management procedures. What does a finance and risk manager do? For a review of what risk management is and what elements are necessary for risk management implementation, visit the other articles in this.

Responsibilities of a financial risk manager. As a risk professional, there are a number of responsibilities which include developing a risk management framework for the clearing of otc (over the counter) financial derivatives products such as irs, fxt, fras and total return swaps. Prepare action plans to decrease risk factors.

Liaising with stakeholders and board members. A financial risk manager is typically responsible for: Risk management duties and responsibilities of the job.

An environmental compliance specialist evaluates the environmental risk of a company�s policies, procedures and production. Working with internal teams to calculate the risk associated with specific transactions. Graduate degrees look even more impressive on your resum� to potential employers.

Risk managers are employed in finance, information and security, technology, commodity, enterprise, market, credit, environment, corporate. Investigate potential risks and assess those risks The ultimate goal of an organization is to achieve a strategy, said joey gyengo, principal at.

Drafting business continuity plans to reduce or limit risk. Different organizations may also demand different roles in your job according to their goals and needs. Proficiency in risk management, financial analysis, and related software.

Provide a methodology to identify and analyze the financial impact of loss to the organization, employees, the public, and the environment. A risk compliance manager ensures that the organization conducts its business processes in compliance with laws and regulations, professional standards, international standards, and accepted business practices. Managing risk management activities to isolate accountability;

Designing and implementing an overall risk management process for the organisation, which includes an analysis of the financial impact on the company when risks occur. Listed are the common tasks and responsibilities of a risk manager. Risk managers identify risk controls and discuss business contingency plans for unforeseen circumstances to prevent delays in operational services.

However, it should be noted that the tasks may differ and vary depending on which field you are working in.