Maintaining and balancing an automated consolidated system by giving data. They are valuable additions to the.

Track and calculate the organization’s revenues, expenses, assets, liabilities and cash flows for each year and for other periods of time.

What are the roles and responsibilities of staff accountant. They are valuable additions to the. Inspect account books for efficiency and accuracy. Staff accountants and accountants are similar positions, the main difference being experience level.

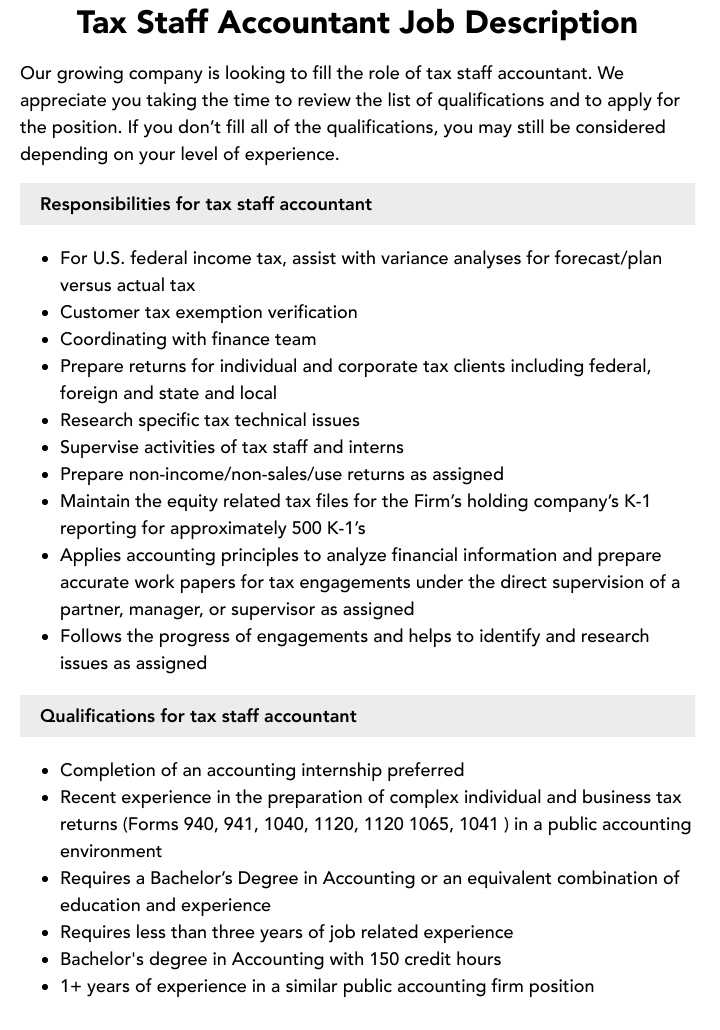

You can easily customize this template to add any accountant duties and responsibilities that are relevant to your company. A staff accountant aids in preparing financial forms and statements on behalf of the company. Please review the list of responsibilities and qualifications.

The staff accountant�s duties and responsibilities will include updating and maintaining financial records and reports, assisting with the budgeting process, assisting with internal audits and performing account reconciliations. However, salary may differ from company to company depending on skills, qualifications, and experience. The accountant should also review the financial statements of the firm.

The staff accountant�s responsibilities include maintaining financial records and reports, performing account reconciliations, assisting with budget and close processes, conducting internal audits, and maintaining accounts payable documentation. Preparing ledger entries by maintaining records and files. Analyzing information and developing spreadsheet reports.

The staff accountant is responsible for billing various grants, performing general ledger account and. Accounting staff duties & responsibilities to write an effective accounting staff job description, begin by listing detailed duties, responsibilities and expectations. Although the daily duties of an accountant will vary by position and organization, some of the most common tasks and responsibilities of accountants include:

Maintain the general ledger chart of accounts. They should perform duties related to the general ledger of the company. Enter accounting related information into business logs.

Preparing internal and external financial statement by gathering information from the general ledger system. They prepare the annual budgets of the organization. Reviewing general ledger accounts and preparing and adjusting journal entries.

The best job descriptions are easy to understand and reflect a sense of priorities. These tasks oftentimes include computing taxes and preparing tax returns, organizing and maintaining financial records, and ensuring statements are accurate. Maintaining general ledger charts of accounts.

Organize and update financial records. Typical duties of a staff accountant. Staff accountants are critical parts of their organizations, and essential in tracking and analyzing budgets, costs, taxes, and cash flow — some of the most vital functions of any business.

Help with the evaluation of internal controls. The staff accountant reports to the senior accounting manager and assists the management and auditing teams as needed. Such knowledge can apply across the company as needed, such as in budgeting or cash.

They ensure that a company complies with all the government rules and regulations. Post monthly, quarterly and yearly accruals. Senior staff accountants resolve account.

They work on preparing the accounting reports in the organization. Staff accountant responsibilities and duties: Use it to save time, attract qualified candidates and hire.

As per the payscale, the average salary of a senior accountant is $68,556. Staff accountants are responsible to maintain the accounts of a firm. Accountants in the united states must perform all of.

They are responsible for the accuracy of the annual figures by issuing accounting statements. What are the duties and responsibilities of a staff accountant? Staff accountants are responsible for preparing and reviewing financial documents, reports, and statements.

Our innovative and growing company is looking to fill the role of accounting staff. Tabulate and pay the company’s income and other taxes. Tracking payments to internal and external stakeholders;

Administer or assist in the administration of payroll for the company or. Review financial statements for accuracy and legal compliance. In addition to this, a staff accountant analyzes financial information and informs management of the best practices the field of accounting.

A staff accountant is an important position in many large businesses. Track and calculate the organization’s revenues, expenses, assets, liabilities and cash flows for each year and for other periods of time. Preparing and maintaining important financial reports.

Performing account analysis and reconciliation, including bank statements and intercompany general ledger accounts. A senior staff accountant is responsible for managing the accounting operations of the company�s accounting department, reconciling accounts, and finalizing financial reports to discuss with the management. We go into more details on the most important staff accountant responsibilities here:

Assisting with initial internal control evaluations. Utilizes accounting system, billing system, spreadsheet, and presentation software. Essential experience, duties & responsibilities:

Those additional benefits may be fixed. Assist in all phases of corporate accounting including but not limited to ap, ar. Most staff accountants list general ledger accounts, financial statements, and special projects as skills on their resumes.

The main role of an accountant is to collect, analyse, record and report the financial data of a company or an individual. Maintaining and balancing an automated consolidated system by giving data. Prepare and adjust journal entries.

Many organizations provide additional benefits also along with the salary to senior accountants. They also oversee all accounting procedures while advising on general finance matters. Ensuring the accuracy of financial documents, as well as their compliance with relevant laws and regulations.

While this is our ideal. You will also be assisting the accounting manager as needed and respond to information requests by. Prepare and file tax returns.

This accountant job description template is optimized for posting on online job boards or careers pages. Here are some typical duties and responsibilities of a staff accountant. The most important skills for a staff accountant to have in this position are analytical skills.

Organize and maintain financial records. Overview responsibilities job descriptions resume examples skills & personality traits. On average, the accountant is more likely to work with balance sheets.

This staff accountant job description template includes the list of most important staff accountant�s duties and responsibilities.it is customizable and ready to post to job boards.