A financial planner, or wealth management advisor, reviews a company’s or individual’s financial statements and finds any potential risks or opportunities for growth. *meeting with a prospective client.

A financial planner can help you plan to achieve lifestyle and financial goals.

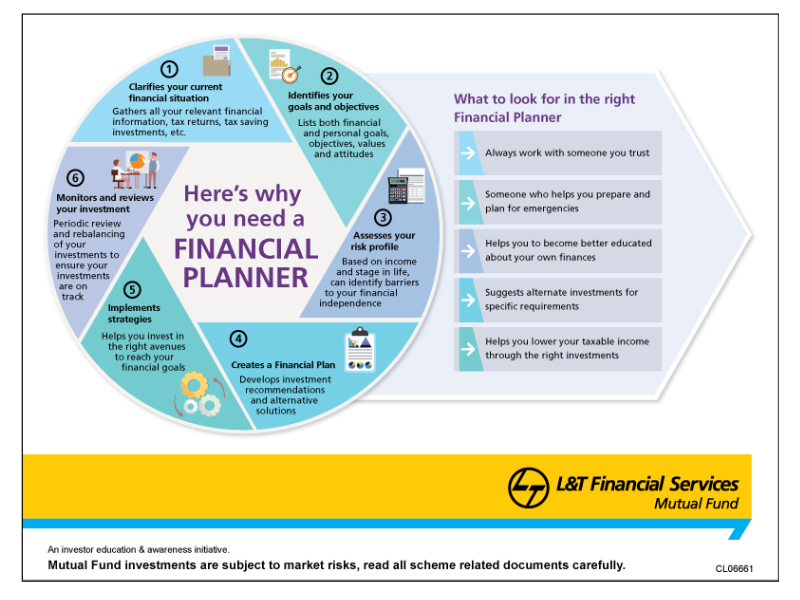

What are the roles of a financial planner. As a general rule, a financial planner’s work can: M y father was a pilot in the second world war. Financial planners are trained to help people understand their current financial status and secure their goals.

In order to achieve this, a financial planner will help their clients formulate a customized plan for meeting their objectives. The role of a financial planner is not only to make you invest, but make you invest in right products that suits your goals and other financial requirement. Selecting the most worthwhile investment strategies.

It encompasses where you are today, your goals, resources, and your desired future state. Exceptional communication, presentation, and negotiation skills communications and interpersonal. Income, expenses and liabilities) examine and suggest financial opportunities (e.g.

Everyone has different financial resources, lifestyle needs and personal aspirations, so the right kind of. A financial planner’s primary role is to assist clients with creating personal budgets; Financial planners analyze the financial statements of a company or individual to identify risks, rewards, and opportunities.

Financial planners work with investment managers, mutual funds, and/or financial advisers to. A financial planner can help you plan to achieve lifestyle and financial goals. Or integrate into the offer of a range of financial.

To offer professional financial advice for customers, helping them to identify problems, solve crises and avoid investment mistakes. Sc chairman datuk syed zaid albar says such an initiative will allow financial planners “to play a vital role in protecting investors against bad investment choices”. Their main duties include developing strategies to help clients maintain their financial goals, analyzing.

A financial planner, or wealth management advisor, reviews a company’s or individual’s financial statements and finds any potential risks or opportunities for growth. Once a financial plan is created, the only thing we know for certain is that the plan will change. The role of a financial planner entails a fiduciary relationship.

Financial planners need an assortment of qualities to perform their job optimally: Insurance plans, investments) develop sound plans and budgets for clients. Also referred to as wealth management advisors, these qualified experts are responsible for analyzing financial statuses, developing budgets, and preparing analysis reports.

Customize financial plans according to clients’ changing needs. He flew wellington bombers for the raf. Practicing in full service personal finance, they advise clients on investments, insurance, tax, retirement and estate planning.

*meeting with a prospective client. The role of a financial planner is often misunderstood, and sometimes it’s just not explained adequately. The confusion can leave many people feeling like they.

At this point, the advisor becomes your coach, reinforcing principles first and keeping you on track. “currently, licensed financial planners can only provide. Financial planners are just one type of financial advisor, along with wealth managers, financial consultants and more.

As a financial planner, you help clients make and implement key decisions about their life and money. Visit edelweiss mf to read more. Help clients implement their plans and carry out transactions.

Planning and consolidating your superannuation fund. That means it is a relationship of trust and therefore integrity of the financial advisor is very important. Even when the strategy is in place, doubts and fears inevitably arise.

A financial planner is part educator, accountant, and financial analyst. The three core roles of a lifestyle financial planner are: Most people believe financial planners are just investment advisors, however a financial planner can provide useful inputs to an individual and family towards handling of many situations during different phases of their life.

Integrate into the range of professional services (eg: The role of a financial/investment planner include things like keeping finances in order, planning for future generations, etc. Ability to analyze the market�s financial data and provide proper financial.

A financial plan is a map of where you are trying to go. *developing yourself professionally and personally (suggestions for career boosting books) but just like the surgeon, there are also tasks essential to being a lifestyle financial planner that are best not carried out by you. Minimizing, controlling, and/or managing expenses;

To educate customers of the importance of wealth management, and to assist them to know more about various financial tools in order to achieve their goals right away. If the financial plan is a map, then the role of the financial planner is to be the guide in the changing landscape of a client’s life. A financial planner or personal financial planner is a qualified financial advisor.

According to the bureau of labor statistics, as of may 2020 (the most recent data available), the total compensation for a financial planner ranged from roughly $44,100 to more than $208,000. Choosing the right insurance to protect your home and business. Analyze clients’ financial statuses (e.g.

3 roles of the financial planner. And implementing the necessary steps for creating and accumulating wealth. Financial planner helps you in understanding your goals, prioritizing your goals, focusing on your goals and makes you understand that when it comes to investing, the only goal that matters.

A financial planner can help you with: